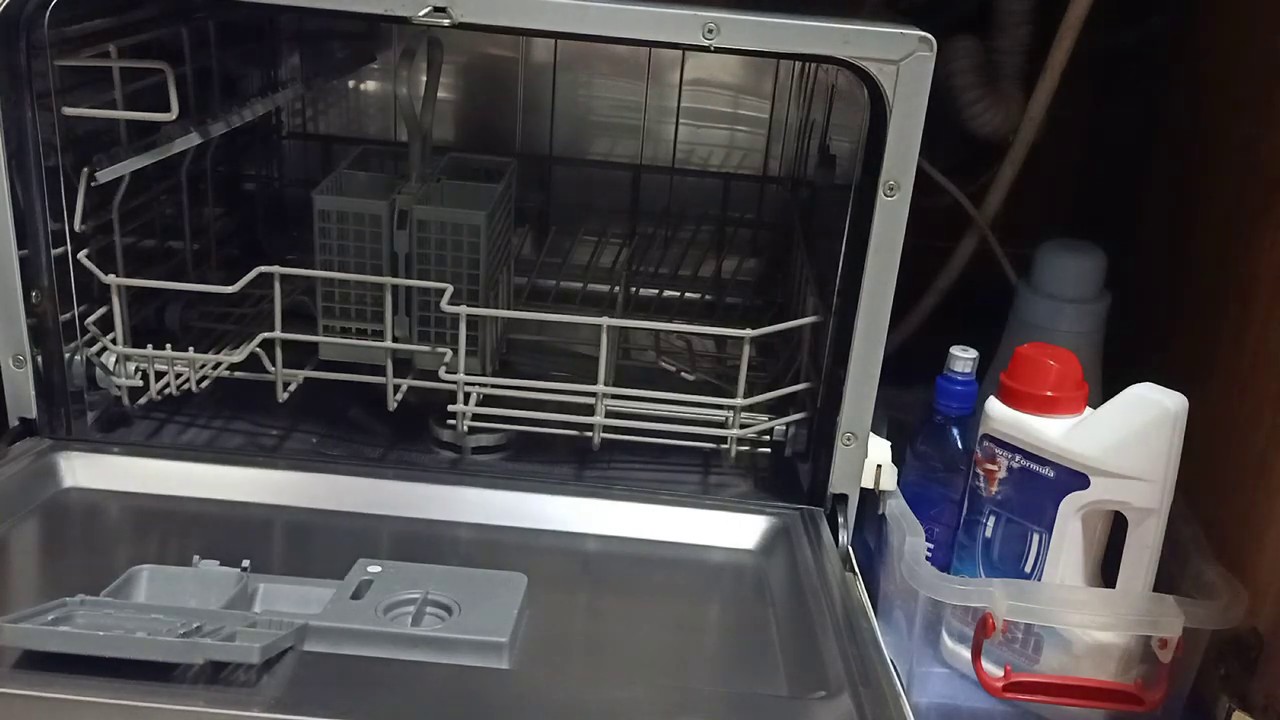

ريفيو تفصيلي غسالة اطباق وايت ويل 6افراد و رد علي اسئلة المتابعين #طريقه_رص الصحون_بشكل_صحيح - YouTube

White Point العبد - ريحي نفسك و وفري وقتك. غسالة أطباق وايت بوينت العبد الصغيرة WPD 6ES تكفي 6 أفراد: مابتحتجش مساحة و اقتصادية تعمل بأقل استهلاك للمياة و الكهرباء و صديقة

وحش "المواعين" .. عيوب وسعر غسالة اطباق وايت ويل 6 افراد | Washing machine, Home appliances, Laundry machine

Cairo Sales Store - وايت ويل غسالة أطباق 6 أفراد لون فضى و هدايا طقم أكواب زجاج 6 قطع بارتفاع 9 سم فرشاة تنظيف الأطباق و الحلل من البلاستيك و البوليستر صفاية