حفل ستيفانو ريتشي للأزياء.. الفنان الهندي (أنيل كابور) مع زوجته في معبد الدير البحري بالأقصر (صور) - ترافل يلا

عندما خطط أبوالعينين وأبدعت مصر| حفل دار أزياء "ستيفانو ريتشي" في "حتشبسوت".. فكرة من ذهب في اليوبيل الذهبي

دار أزياء ستيفانو ريتشي العالمية تختار مصر للطيران لنقل المشاركين في احتفالها بالأقصر - بوابة الشروق - نسخة الموبايل

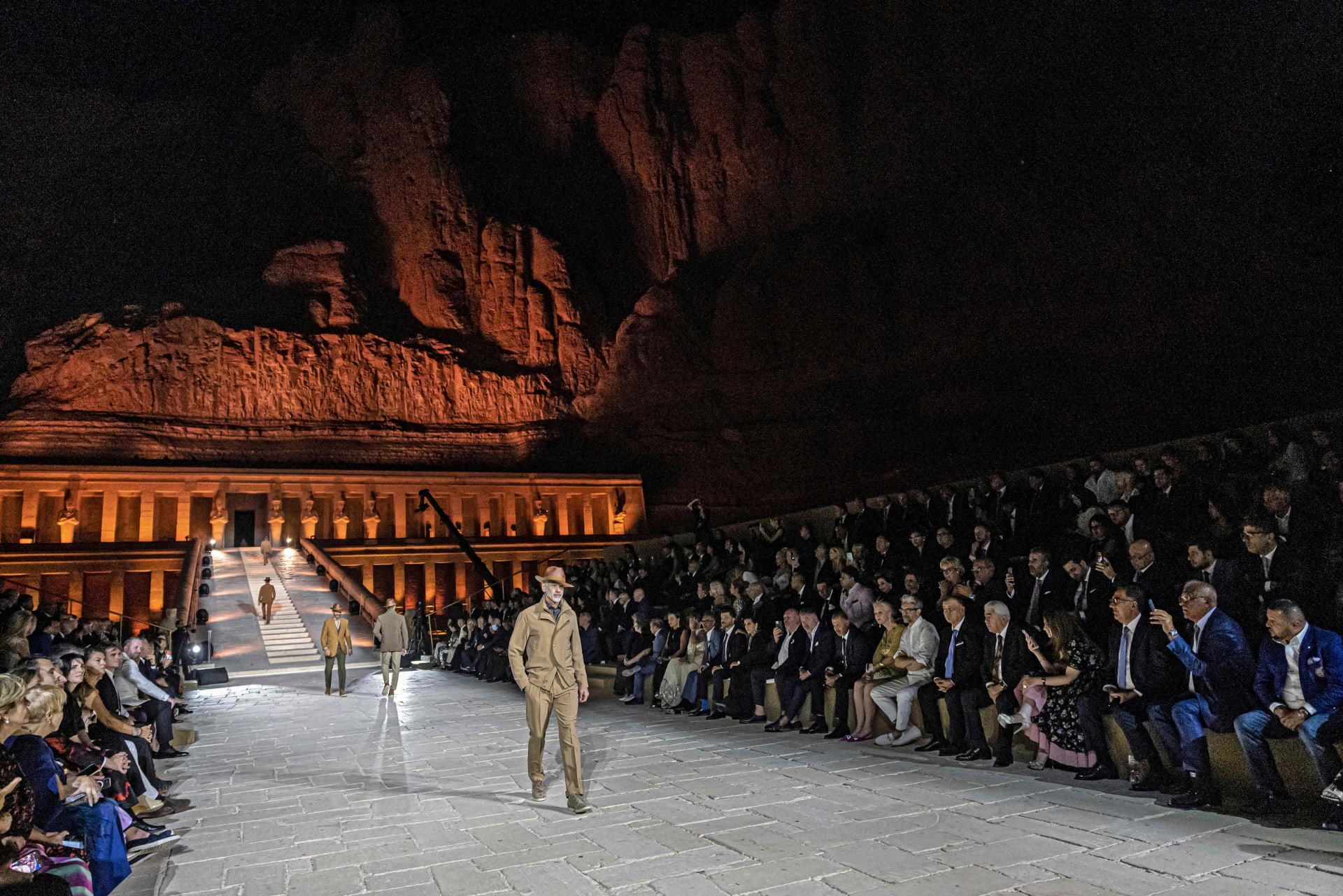

الأقصر تستقبل احتفالية اليوبيل الذهبي لتأسيس دار أزياء ستيفانو ريتشي العالمية للأزياء - موقع العاصمة

انجازات مصر 🇪🇬 Egypt on X: "إحتفلت دار الأزياء الإيطالية "ستيفانو ريتشي" بيوبيلها الذهبي وذلك بإقامة عرض عالمي فى معبد الملكة حتشبسوت بالأقصر. https://t.co/bdCQOfZww3" / X